Right now, the economy and the real estate market seem like scary situations. If you’re getting ready to buy or sell a house, it might feel like you’re jumping out of a plane. You’re worried, uncertain and wondering Is the housing market going to crash?

Yes, there’s lots of speculation about the housing market right now. But crazy headlines and talking heads only affect your long-term money goals if you let them. Don’t fall for the exaggerated fishing tales. And for the love of God, don’t let some twit on Twitter be your only economic indicator!

It’s All About Perspective

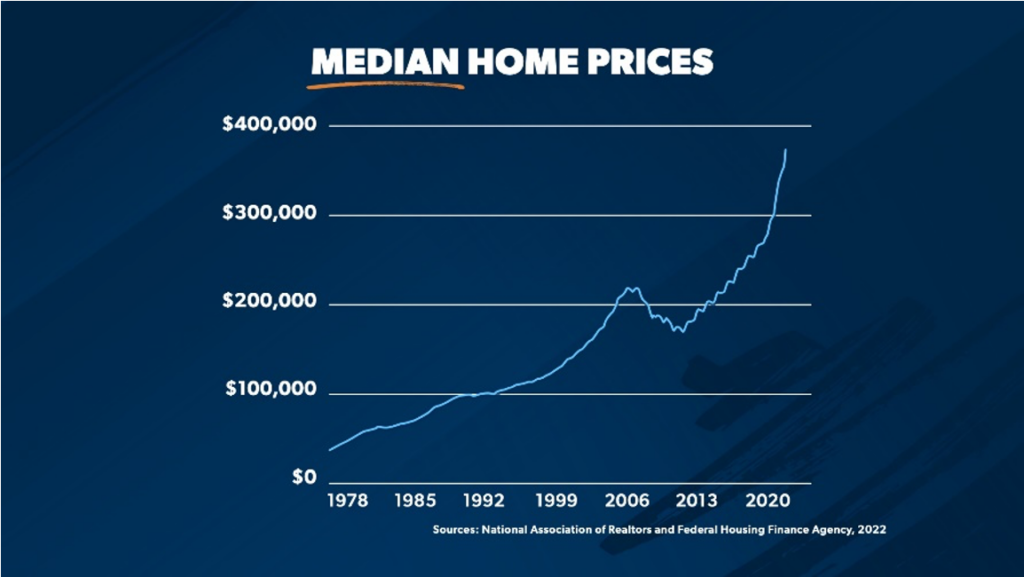

So, what’s the current data telling us? Well, let’s do a real estate reality check. First, let’s talk about house prices.

Housing Price Increases

House prices increased by 29% in 2020 and 18% in 2019.2 These are unprecedented numbers! But what caused the spike? People coming out of their collective caves after quarantine and diving into the housing market like a Baptist after a casserole—that’s what!

Prices are still projected to be up 8% overall this year.3 And in 2023, prices are projected to be up 3-4%, which gets us back to the average increase for residential single-family homes the last 50 years.

Supply and Demand

One thing and one thing ONLY drives house prices: Supply and Demand. Any time there’s more supply of something than there is demand, the price goes down. Any time there’s more demand for something—a lot of buyers chasing a small supply of goods—the price goes up.

For example, if there’s a toilet paper shortage (remember that one?), prices will spike. If there’s a shortage of oil and gas because Washington has turned off the spicket, prices will spike (we’re still living this one!). Real estate is no different. When demand exceeds supply, house prices go up. For housing prices to go down, supply has to exceed demand.

Since we’ve had a shortage of homes for about the last two decades, plus the demand is high, the prices are therefore high. Because of this low supply and high demand, people have been willing to pay ridiculous amounts of money for homes—in many cases, way more than the appraisal price. This has caused people who weren’t even looking to sell their homes to be drawn into the market and become sellers.

Well, let’s take a closer look at the data.

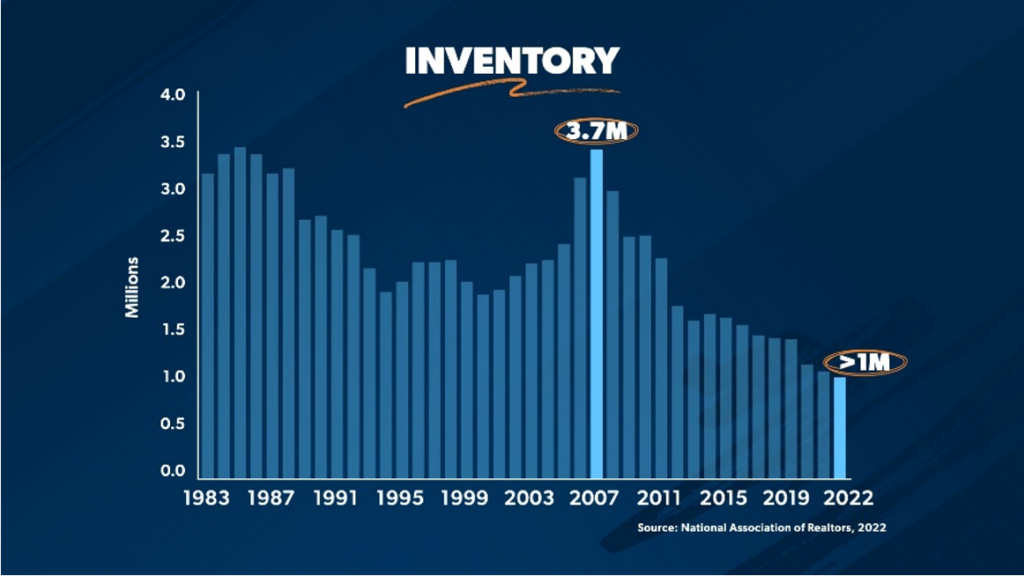

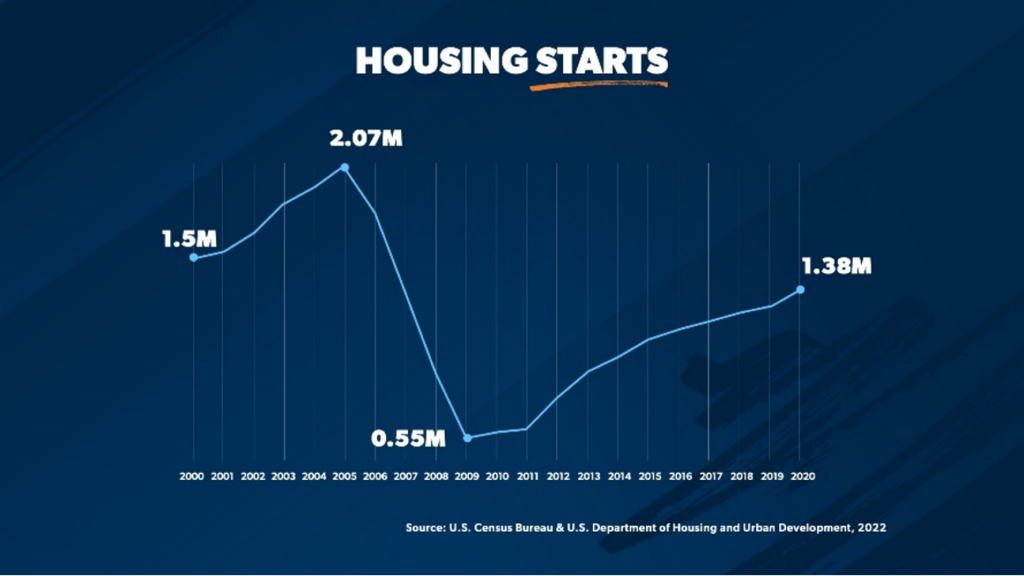

Housing Shortage

In 2008, demand fell dramatically below supply. But currently, our supply of houses for sale is about 1/4 of what it was in 2007, and new housing starts (supply) is 1.38 million—35% lower than the 2.07 million in 2005. 4 As you can see from the inventory and housing starts graphs below, any way you cut it, low used supply and low new supply equal low supply.

Lumber Shortage

On top of that, new housing got totally disrupted during the pandemic with all the supply chain issues. Factories shut down, causing a lumber shortage. Lumber tripled, came down, back up, and now has normalized at around $600 per 100 board feet. But overall, this has negatively affected building starts, leaving us with a shortage of new houses.

Frozen Foreclosures

The government’s moratorium (a fancy word for freeze) on foreclosures during the pandemic is also driving the shortage. Banks stopped executing home foreclosures—essentially letting people live for free the last two years—and now there’s a pileup of homes to be foreclosed on. As the graph shows, we’re starting to see these foreclosures come back into the market. But it’s still not going to provide enough inventory to make up for the housing shortage, and here’s why . . .

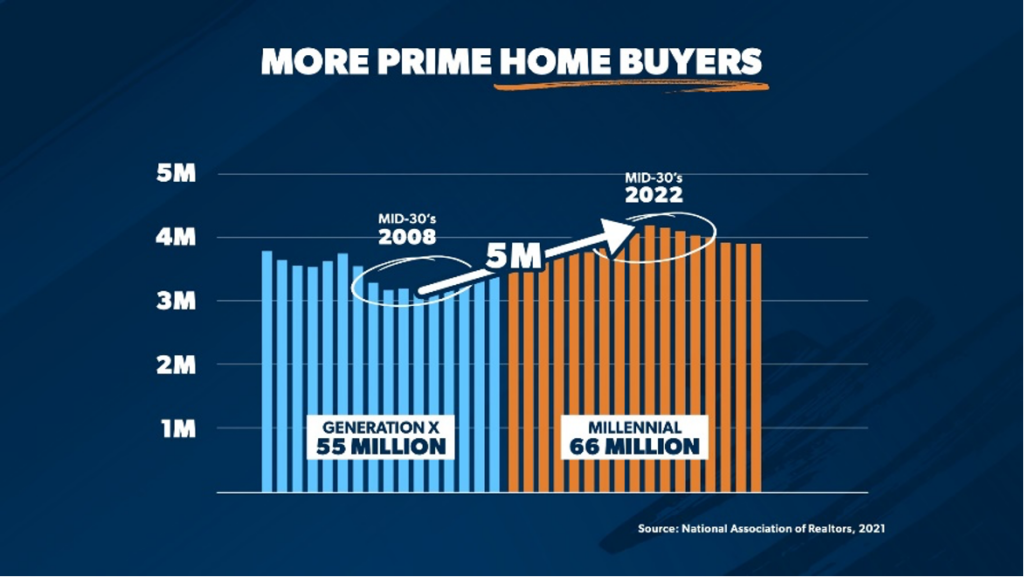

High Demand

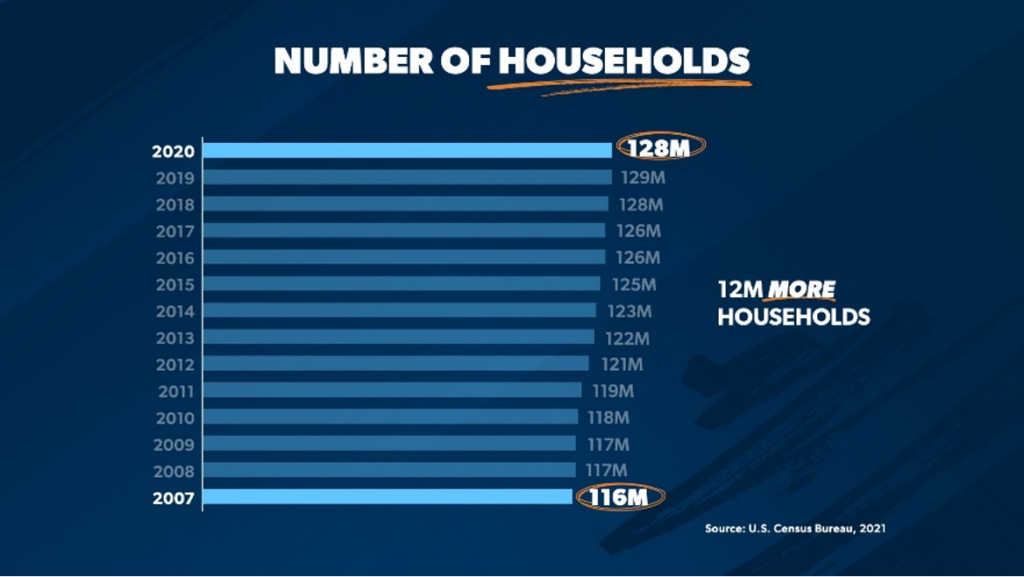

Millennials have come of age—prime earning and home-buying age, that is. There are now 5 million more Millennials in their mid-30s than compared to 2006 when Generation X was in their mid-30s.5 Plus, in 2007 there were 116 million households in the U.S. compared to 128 million households in 2020. That’s 12 million more households wanting to own a home today.6 This makes for too many buyers chasing too few houses.

Investor Buyers

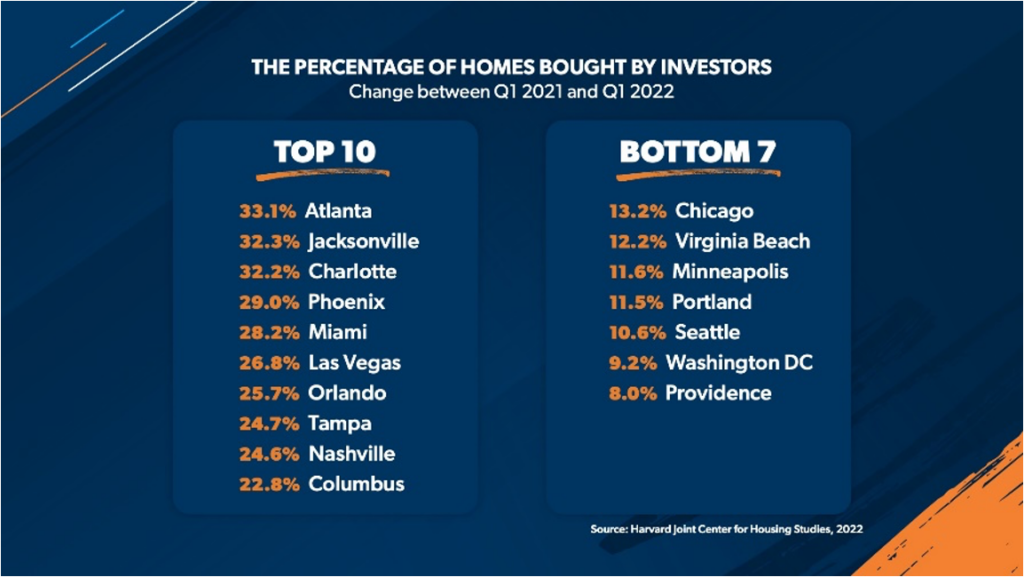

In 2007-2008 we had almost zero institutional investors in the market buying up houses. Today we’ve got these big investing conglomerates buying single-family homes like crazy. According to a report by the Harvard Joint Center for Housing, they bought 28% of the houses that were for sale in America in the first quarter of 2022. That’s up 19% year over year.7

Of course, they’re not buying up homes in the problem cities. They’re buying in more appealing sunbelt cities like Atlanta, Jacksonville and Charlotte and avoiding places like Chicago, Minneapolis, and Portland where there’s lawlessness, high taxes, and Covid-limiting freedoms.

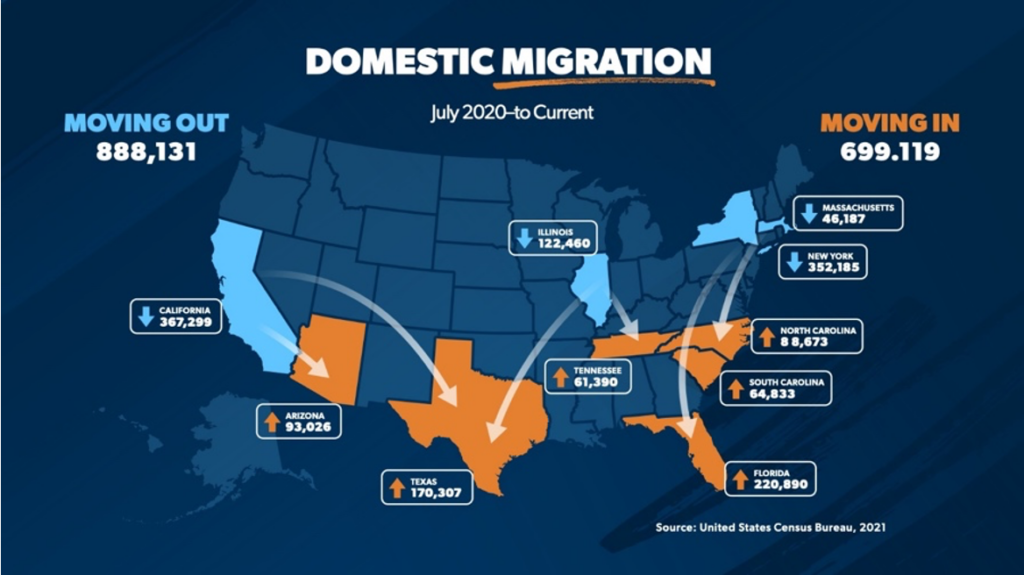

The Great Migration

And investors haven’t been the only ones seeking out better cities. The past two years, there’s also been a mass exodus of people across America moving out of undesirable political environments, tax environments and high-crime environments. We haven’t seen anything like this since the Dust Bowl. Big home sales in California and New York that turn into cash offers for twice the house in Texas or Tennessee have greatly affected the supply-demand curve in local markets.

Interest Rates

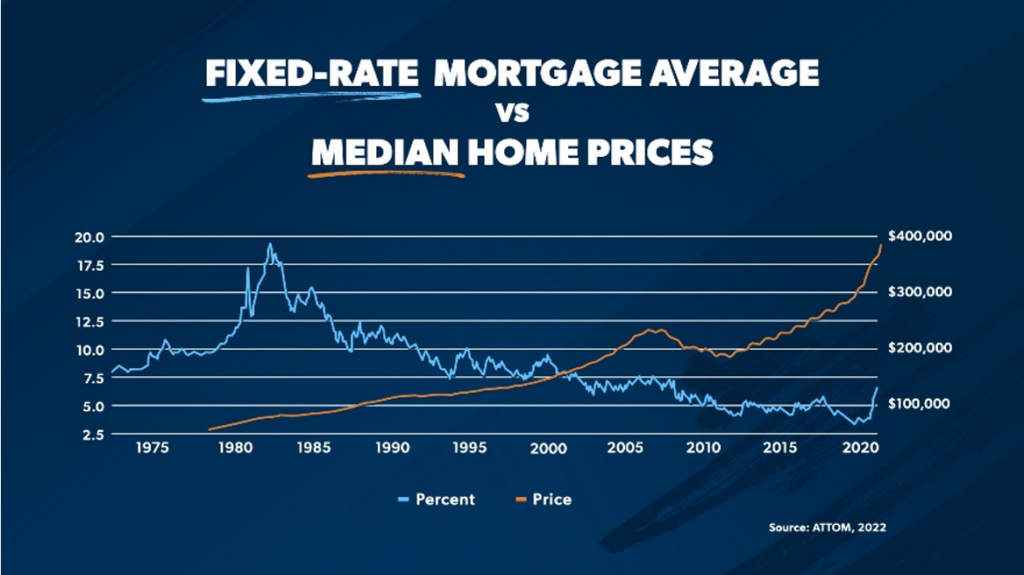

On top of all this chaos, it’s been a bit of a shock to our system to see interest rates rise. It feels like they’re at an all-time high, but in fact they’re just starting to normalize. We have to keep perspective and remember that in 2020 and 2021, interest rates were at an all-time low. We reached our all-time high in the ‘80s when rates averaged around 17%.

I was selling real estate in 1981 when mortgage interest rates went to 18% and there was no “Housing Crash,” no huge drop in prices. We didn’t sell many houses and some sellers used price to attract one of the few buyers, but the market as a whole just sat and waited. In 1984, I sold 78 houses with fixed rates of 14%, and there was a line around the block to look at our model homes. That line was made of people who waited on rates to come “down” from 18% to 14%, and even then, there was no “Housing Crash.” Supply and Demand sets prices—nothing else. Not interest rates, not fear and not politics.

When you add up all this low-supply, high-demand data from all these factors, it’s easy to see how people are feeling boxed out of the market. Especially when you added in the fact that inflation just hit 9.1% in June, the largest 12-month increase in 41 years.8 Budgets—and emotions—are maxed.

Yes, there are lots of things you can’t control, such as:

But there’s one important thing you can control . . . YOU!

Oddly enough, we can actually say with accuracy that this is a great time to buy a house AND it is also a great time to sell a house—if YOU are ready.

Bottom line: Life is not a snapshot, it’s a film strip. Don’t let the scariness of one moment cause you to do something desperate or greedy. Base your decisions on facts, not fear. If you’re in a position to buy or sell, don’t wait on the “Housing Market Crash” because it’s not coming.

Source: Ramsey Solutions. https://www.ramseysolutions.com/real-estate/is-the-housing-market-going-to-crash

![]()